Blockchain Security: How to Spot Weak Links and Avoid Crypto Scams

When you hear blockchain security, the system that keeps cryptocurrency transactions honest and tamper-proof, you might think of unbreakable codes and military-grade encryption. But the truth? Most hacks don’t crack the blockchain—they trick the people using it. DeFi security, the practice of protecting decentralized finance apps from exploitation is often just good old-fashioned vigilance wrapped in smart contracts. And when a bridge between blockchains fails, or a token’s code has a hidden backdoor, it’s rarely the math that breaks—it’s the trust placed in the wrong place.

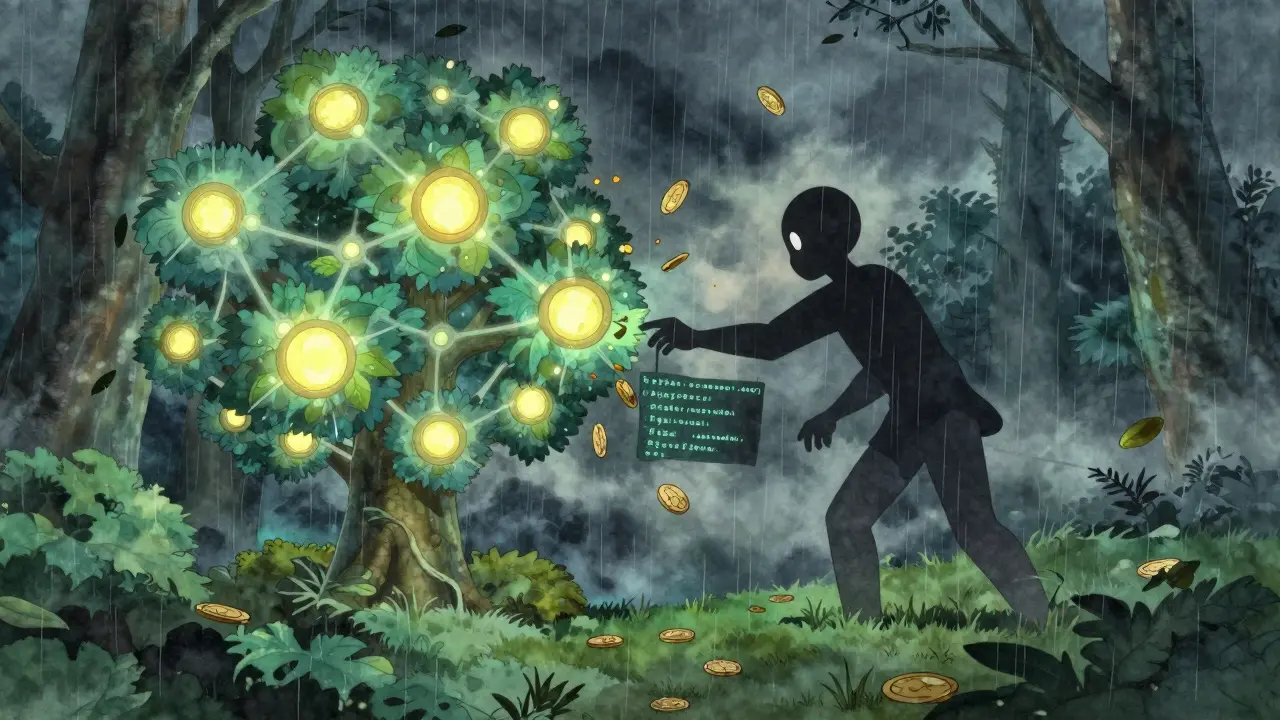

Real-world attacks like flash loan attacks, a technique where hackers borrow millions in seconds to manipulate prices and drain funds don’t need to break into wallets. They just need to find a DeFi protocol that doesn’t properly check price feeds. That’s why some platforms lose millions while the blockchain itself stays perfectly fine. blockchain bridges, the tunnels that move crypto between networks like Ethereum and Solana are another weak spot. Trusted bridges rely on a few operators—so if those operators get hacked or go rogue, your money vanishes. Trustless bridges sound safer, but they’re often slower, more complex, and still prone to bugs. And then there’s crypto scams, fake airdrops, dead tokens, and phantom projects that promise riches but deliver nothing. You’ve seen them: WifeDoge, ZWZ, WSPP, ORI Orica—names that sound real, but have no team, no code, no future. These aren’t hacks. They’re cons, dressed up as innovation.

What ties all these together? A false sense of safety. People think if it’s on a blockchain, it’s secure. But a blockchain is just a ledger. It doesn’t care if you send your coins to a scammer. It doesn’t know if a token has zero users or if a bridge is controlled by one person in a basement. The real security comes from asking hard questions: Who built this? Is anyone still updating it? Does this project have real users, or just hype? The posts below show you exactly how these failures play out—whether it’s a $37 coin that died overnight, a crypto exchange with no verified volume, or a "charity" airdrop that’s just a trap. You won’t find fluff here. Just the facts behind the scams, the broken tech, and the smart ways to protect what’s yours.