Impermanent Loss Calculator

Calculate Your Impermanent Loss

Enter how much the price of your token has changed compared to when you deposited to see how much value you've lost.

Results will appear here after calculation

Imagine putting $1,000 worth of ETH and USDC into a liquidity pool on a decentralized exchange, only to find out later that your position is worth $900-even though ETH went up 50%. That’s not a mistake. That’s impermanent loss. It’s one of the most misunderstood risks in DeFi, and if you’re providing liquidity, you need to know how it works-before you lose money.

What Is Impermanent Loss?

Impermanent loss happens when you provide liquidity to a decentralized exchange (DEX) like Uniswap or SushiSwap, and the price of the two tokens in your pool changes compared to when you deposited them. It’s called "impermanent" because if the prices return to their original ratio, the loss disappears. But if they don’t, it becomes permanent-meaning you end up with less value than if you’d just held the tokens in your wallet. This isn’t about hacking or scams. It’s built into how automated market makers (AMMs) work. AMMs don’t use order books like Coinbase or Binance. Instead, they use math-specifically, the constant product formula: x × y = k. Here, x and y are the amounts of two tokens in the pool, and k is a fixed number. When someone trades, the algorithm adjusts the token amounts to keep k constant. That’s where your loss comes from.How Impermanent Loss Actually Happens

Let’s walk through a real example. You deposit 1 ETH and 2,000 USDC into an ETH/USDC pool. At that moment, ETH is worth $2,000, so your deposit is 50/50 by value. A week later, ETH rises to $4,000. Traders notice the price difference between the DEX and the open market. They buy ETH from your pool at $2,000 and sell it elsewhere for $4,000. This keeps happening until the pool’s price matches the market. To do that, the AMM sells ETH from your pool and buys USDC. By the time it’s balanced, your pool might have 0.707 ETH and 2,828 USDC. Your total value? 0.707 × $4,000 + 2,828 = $5,656. That sounds good, right? But here’s the catch. If you’d just held your 1 ETH and 2,000 USDC, you’d have $4,000 + $2,000 = $6,000. You lost $344. That’s impermanent loss. The math isn’t magic-it’s predictable. The formula for impermanent loss is:IL = 2 × (√P / (1 + P)) - 1

Where P is the price ratio (new price / original price). Plug in 2 (because ETH doubled), and you get:2 × (√2 / (1 + 2)) - 1 = 2 × (1.414 / 3) - 1 = 0.943 - 1 = -0.057

That’s a 5.7% loss. But wait-you had $4,000 in ETH and $2,000 in USDC. The loss is 5.7% of the total $6,000 you’d have held, which equals $342. Matches our example.Why It’s Worse Than It Looks

Most people think: "I made $344 in trading fees, so I’m ahead." But fees don’t always cover the loss. And they don’t come evenly. In a high-volume pair like ETH/USDC, you might earn 0.3% per trade. If there are 100 trades in a week, that’s 30% of your pool’s value in fees-easily covering a 5.7% loss. But in a low-volume pair? You might earn $10 in fees while losing $200 in impermanent loss. And it gets worse with bigger price swings. If ETH goes from $2,000 to $5,000 (2.5x), your impermanent loss jumps to 18.3%. At 5x, it’s 33.6%. At 10x? You lose nearly 50% of your potential value. That’s why providing liquidity to new altcoins with wild price swings is risky.

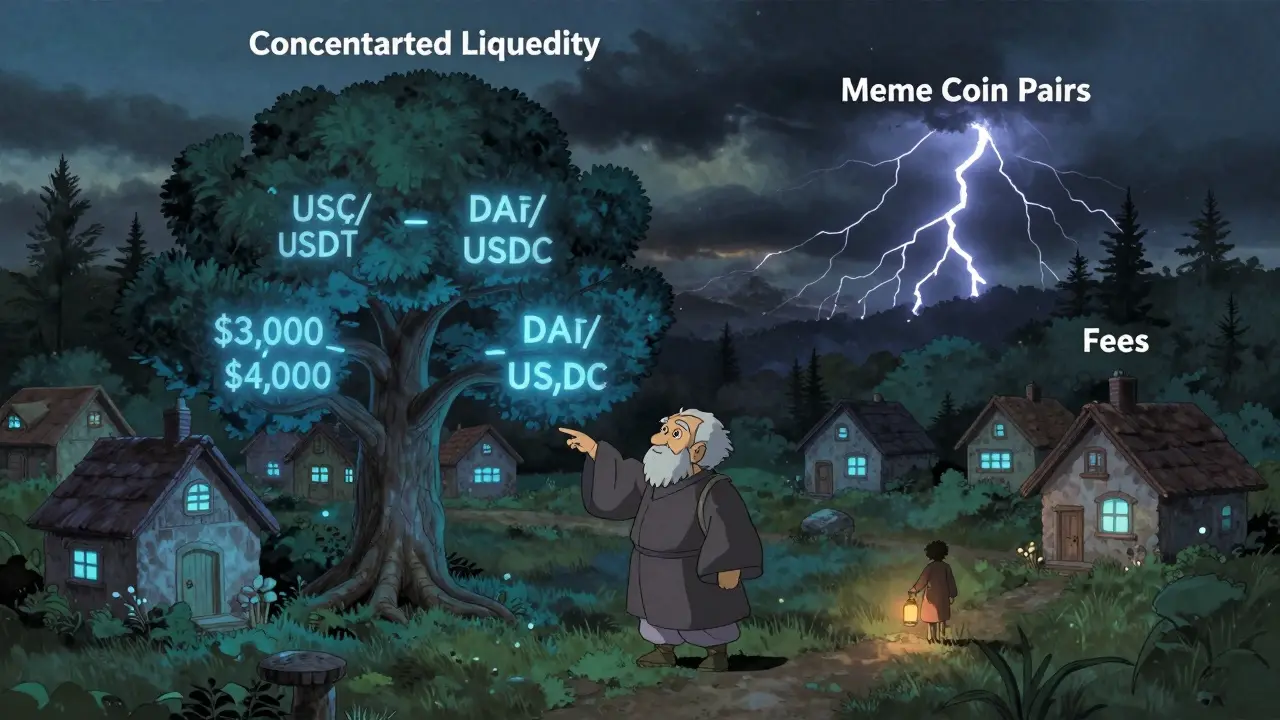

Stablecoin Pairs: The Safe Option

If you want to avoid impermanent loss, stick to stablecoin pairs: USDC/USDT, DAI/USDC, or even FRAX/USDC. These tokens are designed to stay at $1.00. Even if there’s a tiny deviation-say, USDC drops to $0.995-it gets corrected quickly by arbitrageurs. The loss is often less than 0.1%. Many experienced liquidity providers use stablecoin pools as their main source of yield. They earn fees without worrying about price swings. Some even use them as a "parking spot" between trades in riskier pairs. In fact, over 60% of total value locked (TVL) in DeFi liquidity pools is in stablecoin pairs, according to DeFi Llama data from August 2024. That’s not because they’re exciting-it’s because they’re predictable.When Impermanent Loss Is Worth It

It’s not all bad. Sometimes, the fees make up for it-and then some. Take ETH/BTC. Both are volatile, but they often move together. If ETH goes up 30% and BTC goes up 25%, the price ratio barely changes. Impermanent loss? Almost nothing. But trading volume? Huge. You might earn 0.5% in fees per trade-and if the pair trades $10 million in a day, your 0.5% fee on $10 million is $50,000. Even if you’re only providing 1% of the liquidity, that’s $500 in fees in one day. The key is matching volatility with volume. High-volume, low-ratio-change pairs are your sweet spot. ETH/USDC, SOL/USDC, and AVAX/USDC often fit this profile. Avoid pairs where one token is a new meme coin with no real trading history. Those are lottery tickets with high odds of losing money.How to Manage Impermanent Loss

You can’t eliminate it-but you can control it.- Use impermanent loss calculators. Tools like DeFiSaver or CoinGecko’s IL calculator let you plug in your deposit and predicted price change. See the loss before you commit.

- Start with stablecoins. Learn how pools work with minimal risk before touching volatile assets.

- Monitor your position. If ETH surges 40% in a week, consider withdrawing and re-depositing. You’ll pay gas fees, but you might lock in gains and reset your exposure.

- Look for concentrated liquidity. Uniswap V3 lets you set a price range for your liquidity. If ETH trades between $3,000 and $4,000, you only provide liquidity in that range. Your capital works harder, and your exposure to extreme moves drops.

What Experts Say

Kraken’s research team calls impermanent loss "an inherent feature of AMMs, not a bug." They say it’s the price of decentralization. You’re giving up control over asset pricing to let anyone trade without intermediaries. In return, you get fees-but you also get volatility risk. Cointelegraph compares it to planting seeds in a flood-prone garden. You nurture them, but if the river rises, your crop washes away-even if the soil was perfect. The smartest liquidity providers treat it like insurance. They calculate the cost of loss against the potential reward. If the fee yield is 20% APY and the expected impermanent loss is 8%, they’re net positive. If it’s 5% APY and 15% loss? Walk away.Real User Stories

On Reddit, one user deposited 5 ETH and 10,000 USDC into an ETH/USDC pool in January 2024. ETH rose to $4,500 by March. He had 3.53 ETH and 15,909 USDC. His pool value: $25,800. If he’d held, he’d have $22,500 + $10,000 = $32,500. He lost $6,700. But he earned $1,800 in fees. Net loss: $4,900. He withdrew, bought more ETH, and waited. Another user stuck with USDC/DAI for a year. Lost less than 0.5% in impermanent loss. Earned $1,200 in fees on a $50,000 deposit. That’s 2.4% APY-safe, steady, and no sleepless nights.Final Thoughts

Impermanent loss isn’t a trick. It’s a trade-off. DeFi gives you access to yield without middlemen. But with that freedom comes responsibility. You’re not just earning fees-you’re acting as a market maker. And market makers don’t profit from price moves. They profit from volume and volatility. If you’re new to DeFi, start with stablecoins. Learn how the math works. Use calculators. Don’t chase high APYs on unknown tokens. And always ask: "Am I getting paid enough to take this risk?" The best liquidity providers aren’t the ones who guess right on price. They’re the ones who understand the system-and avoid the traps before they fall in.Is impermanent loss real or just theoretical?

It’s real. If you withdraw from a liquidity pool after asset prices change, you’ll see your value is lower than if you’d held the tokens. It’s not a glitch-it’s how AMMs are designed. Many users have lost thousands of dollars because they didn’t understand it before depositing.

Can you avoid impermanent loss entirely?

You can’t avoid it completely if you’re providing liquidity to two volatile assets. But you can minimize it by using stablecoin pairs like USDC/USDT, where price changes are tiny. Concentrated liquidity in Uniswap V3 also reduces exposure by limiting your range.

Do trading fees cover impermanent loss?

Sometimes. In high-volume pairs like ETH/USDC, fees can easily offset losses-even during big price moves. But in low-volume or highly volatile pairs, fees may be too small to make up for the loss. Always calculate both before depositing.

Why does impermanent loss increase exponentially with price changes?

Because AMMs use a constant product formula (x × y = k). When one asset’s price doubles, the pool automatically sells half of that asset to rebalance. You end up with fewer of the rising asset and more of the stable one. The math forces you to sell high and buy low-exactly the opposite of what you’d do if you were holding.

Is impermanent loss the same as a loss on your investment?

Not exactly. It’s an opportunity cost. You didn’t lose money to a scam or a crash. You lost potential value because you chose to provide liquidity instead of holding. If prices return to their original ratio, the loss disappears. That’s why it’s called "impermanent." But if you withdraw before that happens, it becomes real.

Should I use impermanent loss protection tools?

Some protocols now offer insurance against impermanent loss, but they often come with high fees or lock-up periods. For beginners, it’s better to learn how to avoid the loss through smart pair selection than to pay for insurance. These tools are still experimental and not widely trusted.

Can I lose more than I deposited?

No. Impermanent loss only reduces your value compared to holding. You won’t owe money. The worst-case scenario is that your pool value drops to zero-but that only happens if one of the tokens becomes worthless, which is a separate risk (token collapse), not impermanent loss.

Doreen Ochodo

December 6, 2025 AT 00:12Stablecoin pools are the real MVPs. No stress, no sleepless nights, just steady fees. I keep 80% of my LP in USDC/DAI and call it a day.

ronald dayrit

December 6, 2025 AT 08:45Impermanent loss isn’t a bug-it’s the universe’s way of reminding you that you’re not a market maker, you’re just a guy with a wallet trying to get rich quick. The constant product formula doesn’t care about your dreams, your rent, or your crypto Twitter persona. It just balances. And when ETH goes from $2k to $5k, it quietly sells your ETH at $2k and buys USDC at $1, because math doesn’t have feelings. You think you’re earning yield? You’re just the liquidity equivalent of a human ATM that gets drained every time someone smarter than you figures out arbitrage. The only people who truly win are the ones who never deposited in the first place-or those who use Uniswap V3 and lock their liquidity in a $3.5k–$4k range like grown-ups.

And don’t get me started on those ‘high APY’ meme coin pools. You’re not farming yield, you’re handing your money to a Discord admin who doesn’t even know what a smart contract is. I’ve seen people lose $15k on a token called ‘DogeCoin2.0’ because they thought ‘community-driven’ meant ‘not a rug.’ Spoiler: it didn’t.

The real insight here isn’t the math-it’s the psychology. You’re not investing. You’re gambling with a spreadsheet. And the only way to win is to stop pretending you’re Warren Buffett with a MetaMask wallet.

Holly Cute

December 7, 2025 AT 10:19Oh wow, another ‘educational’ post that makes impermanent loss sound like a minor inconvenience 😂. Let me guess-you’re one of those people who ‘earned $1,800 in fees’ but lost $6,700 and still think it’s ‘worth it’? That’s not a strategy, that’s a cry for help. And ‘stablecoin pairs are safe’? LOL. What about depegging? USDC dropped to $0.87 in 2023, remember? You think your ‘safe’ $50k in USDC/DAI is safe? Nah. You’re just sleeping through the next financial crisis while sipping your oat milk latte. And don’t even get me started on ‘concentrated liquidity’-that’s just leverage with extra steps and more gas fees. You’re not protecting yourself-you’re just building a bigger house on a fault line. 🤡

Josh Rivera

December 7, 2025 AT 23:01So let me get this straight-you’re telling people to ‘start with stablecoins’ like that’s some genius move? Bro, you’re literally playing DeFi on easy mode. If you’re not risking your skin, you’re not earning. The whole point of crypto is to outsmart the system, not to park your cash like a retiree. And ‘use calculators’? That’s not wisdom, that’s fear in Excel form. If you need a calculator to tell you not to lose money, maybe you shouldn’t be in DeFi at all. Just put it in a savings account and stop pretending you’re a pioneer.

Yzak victor

December 8, 2025 AT 03:12Hey, I’ve been in and out of LPs for a couple years now. The key? Don’t overthink it. I started with USDC/DAI, learned how the pool moves, then dipped a little into ETH/USDC when I felt the vibes. Didn’t lose my shirt, didn’t chase 50% APYs. Just kept it chill, watched the fees, and pulled out when things got wild. It’s not about being the smartest guy in the room-it’s about not being the guy who got wiped out because he thought ‘it’ll bounce back.’ Honestly, most of the drama here is just noise. Do your homework, stay humble, and don’t let FOMO turn your portfolio into a horror story.

Neal Schechter

December 8, 2025 AT 08:45One thing people forget: impermanent loss only matters if you withdraw. If you’re in it for the long haul and the token you’re paired with ends up going 10x, you’re still ahead-because your liquidity position gives you exposure without needing to buy more. I’ve held ETH/USDC since 2022. Lost a few grand during the 2023 dip, but the fees covered it, and now I’ve got more ETH than I originally deposited. It’s not magic. It’s patience. And yeah, stablecoins are boring-but boring is how you survive. You don’t need to be a hero. You just need to be here when the dust settles.

Madison Agado

December 8, 2025 AT 12:24The real tragedy isn’t the math-it’s that people treat DeFi like a casino and then act shocked when they lose. Impermanent loss is just a mirror. It shows you whether you’re trading or speculating. If you’re in it for the fees, fine. If you’re in it because you think ETH will double and you’ll magically profit from the pool-then you’re not a liquidity provider. You’re a gambler with a PhD in blockchain. The formula doesn’t lie. But people? They lie to themselves every day. And that’s the real impermanent loss.

Tisha Berg

December 8, 2025 AT 23:53Start small. Stick to stablecoins. Learn the rhythm. That’s all you need. No need to be fancy. No need to chase gains. Just be consistent. You’ll thank yourself later.

Billye Nipper

December 9, 2025 AT 09:04I just wanted to say… thank you. 🙏 I was so confused about why my ETH/USDC pool kept losing value even though ETH was going up… I thought I was doing something wrong. I checked the calculator, saw the 5.7% loss, and cried a little. But now I get it. It’s not me. It’s the system. And now I’m moving 70% of my funds to USDC/USDT… and I feel… lighter? Like I just unburdened my soul. I’m not ‘missing out’-I’m protecting my peace. 💖

Roseline Stephen

December 10, 2025 AT 04:22Interesting breakdown. I’ve been on the sidelines watching. Not sure if I’m ready to jump in yet. But I appreciate the clarity. I’ll keep learning.