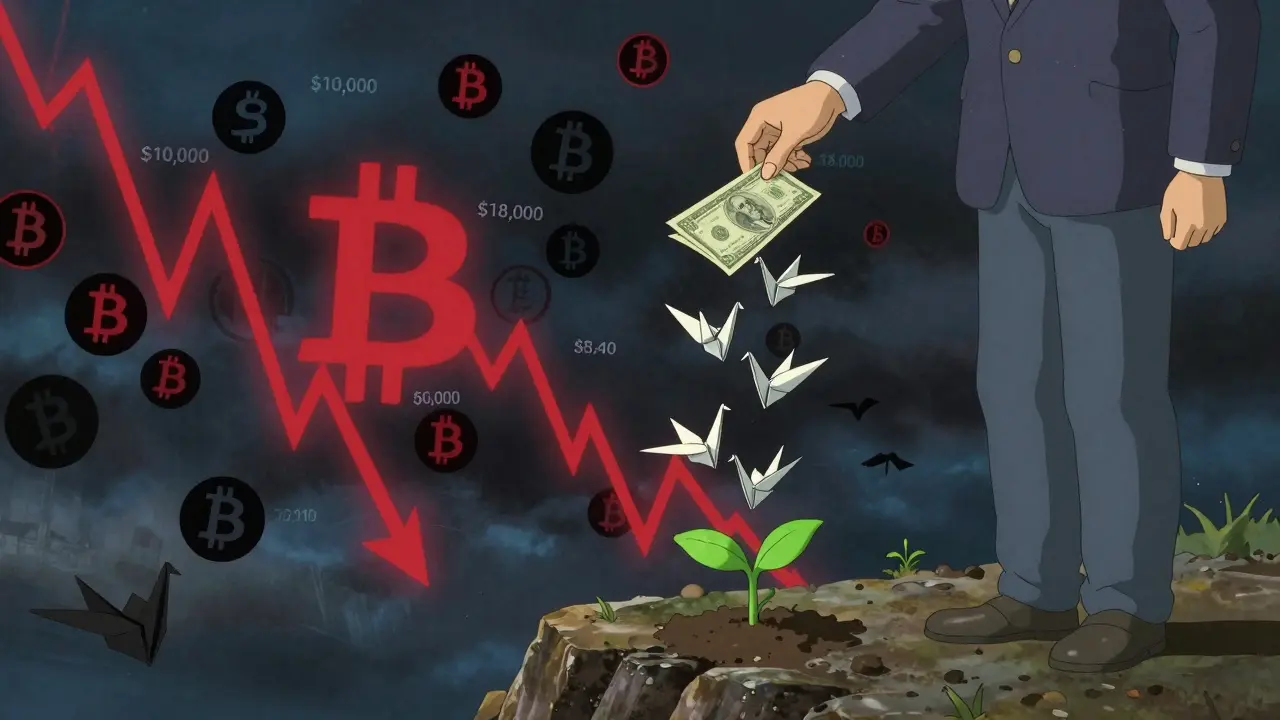

When you’re buying crypto, timing the market feels like trying to catch a falling knife-messy, dangerous, and usually ends in regret. That’s why so many long-term investors turn to dollar-cost averaging (DCA). It’s not flashy. It doesn’t promise quick riches. But over time, it works-no matter if the market is soaring or sinking.

What DCA Actually Does in a Bull Market

In a bull market, prices climb steadily. Bitcoin might go from $30,000 to $70,000 over 18 months. Ethereum follows. Altcoins jump even harder. At first glance, DCA looks like a bad idea. Why buy slowly when everyone’s rushing in? Here’s the truth: you’re not trying to win the sprint. You’re playing the marathon. When you invest $100 every week in a rising market, you buy fewer coins each time. That means your average cost per coin goes up. But here’s the catch-you’re still buying. You’re not sitting on the sidelines waiting for a pullback that never comes. Historical data from Russell Investments shows bull markets last, on average, 51 months. That’s over four years. Bear markets? Just 15 months. So even if you’re paying more per coin during a bull run, you’ve got way more time for those coins to grow. And because you’re investing regularly, you avoid the mistake of putting all your money in at the top. Take someone who invested $100 a week in Bitcoin from January 2020 to December 2021. They bought during the slow climb, the breakout, and the parabolic run. Their average cost was around $18,000 per BTC. By the end of 2021, Bitcoin hit $69,000. Even though they paid more per coin as prices rose, they still made over 280% on their total investment. That’s the power of staying in.How DCA Saves You in a Bear Market

Bear markets are where DCA shines. Prices drop. Fear spreads. News sites scream “Crypto is dead!” You see your portfolio down 50%. It’s tempting to stop investing-or worse, sell. But if you keep DCA going, you’re doing something powerful: buying more coins for the same amount of money. When Bitcoin drops from $60,000 to $30,000, your $100 buys twice as much. When it hits $18,000? You’re getting over three times the coins you did at the peak. Charles Schwab’s research shows that during past bear markets, investors who kept investing through the downturn ended up with significantly lower average cost bases. For example, during the 2018-2020 crypto bear market, Bitcoin fell from nearly $20,000 to under $4,000. Someone who kept buying $50 a week bought 1,500% more coins in the last six months of the drop than they did in the first six months. That’s not luck. That’s math. And it’s why DCA is called “buying the dip” without having to guess when the dip ends.DCA vs Lump Sum: The Real Numbers

A common question: “Wouldn’t I make more money if I just dumped all my cash in at the bottom of a bear market?” The answer? Maybe. But you’d have to get it right. Schwab analyzed 92 years of market data across stocks and bonds. They compared lump-sum investing (putting everything in at once) with DCA over the same period. In bull markets, lump sum won about 67% of the time. But here’s the twist: in bear markets, DCA outperformed lump sum 78% of the time-because lump sum investors often waited too long to invest, fearing more drops. The real danger isn’t buying too early. It’s missing the recovery. The biggest gains in a bull market happen in the first few months after a bear market ends. Schwab found that investors who waited just one month after a bear market bottom missed out on 47% of their 12-month returns. Wait six months? You’re left with only 14%. DCA removes that guesswork. You don’t need to predict the bottom. You just keep buying.

Why Emotional Discipline Beats Market Timing

The biggest reason DCA works isn’t math-it’s psychology. Fidelity’s behavioral research shows that most investors sell when markets crash and stay out too long after they recover. That’s called “loss aversion.” You feel the pain of losing money more intensely than the joy of gaining it. So you freeze. You wait. And you miss the rebound. DCA fixes that. It turns investing into a habit. You don’t check the price every day. You don’t panic when Bitcoin drops 10%. You just send the $100. It’s automatic. It’s emotion-free. Merrill Lynch calls this “avoiding bear market rallies”-those fake bounces that trick you into thinking the market’s back. Most people buy during those rallies, only to get crushed again. DCA investors? They keep buying regardless. That’s how they end up with more coins at lower prices.How to Set Up DCA for Crypto

You don’t need a fancy platform. You don’t need to be a trader. Here’s how to do it:- Decide how much you can invest weekly or monthly-start small, even $25 is fine.

- Pick one or two assets you believe in long-term (Bitcoin, Ethereum, maybe one solid altcoin).

- Use your exchange’s recurring buy feature (Coinbase, Kraken, Binance all have it).

- Set the date-every Friday, every 1st of the month. Stick to it.

- Ignore the noise. Don’t check your portfolio every day.

Who Should Use DCA-and Who Shouldn’t

DCA is perfect for:- Long-term investors building wealth over 5+ years

- People who can’t time the market or don’t want to try

- Those who get anxious during price swings

- Anyone with a steady income and small, regular amounts to invest

- You need the money in the next 1-2 years (crypto is too volatile for short-term goals)

- You’re trying to get rich quick (DCA doesn’t work for gambling)

- You can’t stick to it during a crash (if you stop buying, you break the strategy)

Anthony Ventresque

January 18, 2026 AT 03:54DCA is the only way I’ve stayed sane in crypto. I started with $25 a week in 2020, didn’t check my portfolio for 18 months, and now I own more BTC than I ever thought possible. No panic selling. No FOMO. Just consistency.

It’s not sexy, but it works.

And yeah, I still get weird looks from my friends who tried to time the top in 2021 and got wrecked.

Anna Gringhuis

January 19, 2026 AT 09:41Wow. So you’re saying buying when everything’s falling is smarter than waiting for the ‘perfect’ moment?

How radical. Next you’ll tell me breathing is good for you.

Michael Jones

January 20, 2026 AT 14:03Excellent breakdown. The data from Russell and Schwab is particularly compelling. DCA isn’t about maximizing returns-it’s about minimizing regret. And statistically, regret avoidance is the single most effective behavioral strategy in long-term investing.

Also, weekly DCA outperforms monthly in high-volatility environments due to finer price averaging. Daily is overkill unless you’re deploying six figures. Stick to weekly. Set and forget.

Telleen Anderson-Lozano

January 22, 2026 AT 12:29Okay, I’ll admit-I used to think DCA was for losers who couldn’t ‘win’ the market… until I watched my portfolio drop 60% in 2022, and I kept buying… and then I watched it recover… and then I watched it double… and now I cry happy tears every time I see my 12-month chart.

It’s not magic. It’s math. It’s discipline. It’s… okay, fine, I’m converted.

Also, I’m now buying Dogecoin weekly. Don’t judge me. I need hope.

Shaun Beckford

January 22, 2026 AT 17:37Let me guess-you also believe in the tooth fairy and that Elon’s tweets are ‘market signals.’ DCA is a retail investor’s placebo. The whales are dumping on every dip. You’re just the sucker buying the bottom while they short the rally.

And don’t even get me started on ‘compounding’-that’s a word Wall Street uses to make you feel better about being a pawn.

Real investors don’t DCA. They front-run, arbitrage, and exploit liquidity traps. You? You’re the liquidity trap.

Chris Evans

January 23, 2026 AT 01:56The metaphysical truth of DCA lies not in its arithmetic, but in its ontological rejection of temporal anxiety.

By decoupling your agency from market volatility, you enact a Nietzschean will-to-consistency-transcending the herd’s panic-driven binary of FOMO and FUD.

Every $100 you send is a ritual. A sacrament. A quiet rebellion against the temporal tyranny of price feeds.

You are not investing. You are becoming.

And when the blockchain gods smile? You are already there.

Pat G

January 24, 2026 AT 05:14Why are we even talking about this? The government’s printing money. Inflation’s eating your savings. Crypto’s the only real asset left.

And you want to talk about ‘weekly buys’ like it’s a yoga class?

Just buy Bitcoin. Buy it all. Now. Before the Fed bans it.

Stop overthinking. Just buy.

Alexandra Heller

January 25, 2026 AT 22:15You know what’s more dangerous than timing the market? Believing in the myth of ‘fairness’ in finance.

DCA gives you the illusion of control. But the system is rigged. The whales, the exchanges, the VCs-they all front-run your buys.

And yet… you still do it.

Why? Because you need to believe you’re not powerless.

That’s not investing. That’s therapy with a wallet.

myrna stovel

January 27, 2026 AT 08:51For anyone new to this-start small. Even $10 a week. Use a platform you trust. Set it and forget it.

Don’t compare yourself to the guy who doubled his money in 3 months. That’s gambling.

You’re building a life.

And if you miss a week? It’s okay. Just restart. No guilt. No shame.

This isn’t a race. It’s a practice.

You’ve got this.

Hannah Campbell

January 27, 2026 AT 19:10OMG I can’t believe people still fall for this 😭

It’s 2025 and you’re still buying crypto like it’s 2017?

Just wait for the Fed to shut it down next year and then cry into your ramen

LOL

JK I’m just waiting for the next pump so I can short you all 😘

Bryan Muñoz

January 29, 2026 AT 01:40They don’t want you to know this but DCA is a CIA mind control program disguised as investing

They want you to keep buying so they can track your wallet

And when the CBDC launches… your crypto will vanish overnight

They’ve been doing it since 2009

Don’t be a sheep 🐑

Buy gold. Hide it. Burn your phone

Rod Petrik

January 30, 2026 AT 10:32Everyone’s talking about DCA like it’s safe

But have you ever checked the blockchain analytics?

The top 10 wallets control 35% of BTC

Every time you DCA… you’re feeding the algorithm that manipulates the price

They know when you buy

They front-run you

They pump then dump

You’re not investing

You’re the puppet

And the string? It’s coded in Ethereum smart contracts

Wake up

Pramod Sharma

January 31, 2026 AT 05:37DCA works. Simple. No drama.

Start small. Stay consistent.

Time is your friend.

Emotion is the enemy.

Do it.