Leaving your position open overnight with 100x leverage used to be a gamble. Now, it’s a calculated move - if you know where you’re trading. As of 2026, the rules around leverage trading aren’t just changing; they’re splitting apart. What’s allowed in New Zealand might be illegal in the U.S., and what’s banned in Europe is openly offered on offshore crypto exchanges. The future of leverage trading isn’t about one global rulebook anymore. It’s about understanding the patchwork - and knowing which rules actually protect you, and which ones just make trading harder.

Why U.S. Forex Leverage Is Still Locked at 1:50

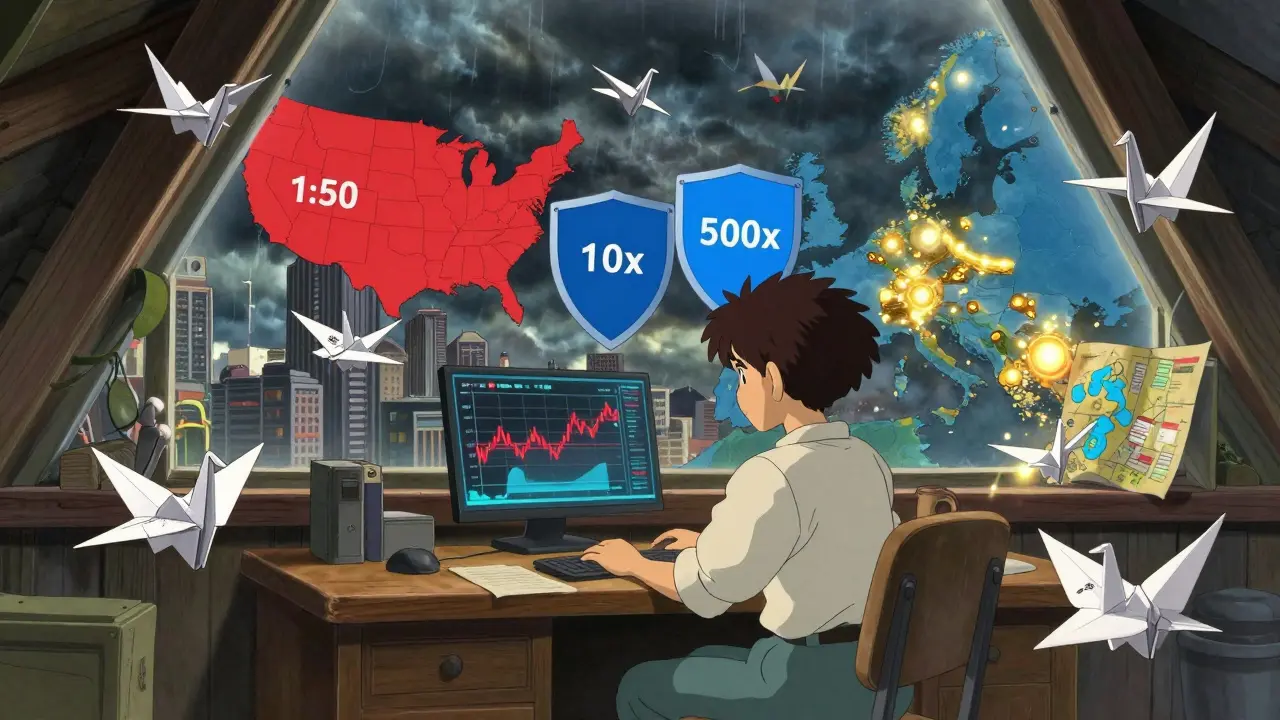

In the U.S., you can’t trade forex with more than 50 times your capital. That’s it. No exceptions. This cap, enforced by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), came after the 2015 Swiss franc crash and the 2020 oil price collapse wiped out thousands of retail traders. Regulators didn’t just want to stop losses - they wanted to stop blowouts. That’s why negative balance protection is mandatory: if your account goes to zero, you don’t owe the broker more. You walk away with nothing, but you don’t get sued. But here’s the catch: this rule only applies to U.S.-licensed brokers. If you’re trading from the U.S. but using a platform registered in the Cayman Islands or Malta, those protections vanish. And many retail traders do. The result? A gray market where U.S. traders access higher leverage through unregulated channels - and take on risks no regulator ever intended them to face.Futures Trading: Leverage That Moves With the Market

Unlike forex, futures don’t have fixed leverage caps. Instead, leverage changes based on volatility. Take crude oil futures: a $75,000 contract might only need $3,750 in margin. That’s 20:1 leverage. But if oil prices swing wildly - say, after a geopolitical event - the exchange might raise the margin requirement to $7,500. Suddenly, your leverage drops to 10:1. It’s automatic. No regulator steps in. The market itself adjusts. This dynamic system works because futures are traded on regulated exchanges like CME Group. They have the infrastructure to monitor risk in real time. Retail traders get flexibility, but they also get responsibility. You can’t blame the broker if your position gets liquidated because you ignored a margin call. The system assumes you understand the math - and the risks.Crypto Leverage: The Wild West With Tools

If you’re looking for 200x, 300x, even 500x leverage, you’ll find it on crypto exchanges like BTCC, BYDFi, and OKX. These platforms don’t just offer high leverage - they’ve built entire ecosystems around it. In August 2025 alone, Leverage.Trading recorded 1.4 million pre-trade risk checks from traders in over 90 countries. That’s not random gambling. That’s preparation. Perpetual futures dominate this space. Unlike traditional futures, they never expire. Instead, they use funding rates - small payments exchanged every eight hours between long and short traders - to keep the contract price close to the spot price. An investor with $5,000 using 10x leverage on Ethereum might control $50,000 worth of ETH. If ETH rises 5%, they make $4,485 in profit. But they also pay $15 in funding fees over 24 hours. That’s the cost of staying in the trade. What’s surprising? These platforms are now pushing risk education harder than regulators. Leverage.Trading’s monthly Global Leverage & Risk Report shows traders are learning to stress-test their positions before opening them. Liquidation simulations spike fivefold before major price moves. Traders aren’t waiting for their accounts to blow up - they’re running simulations first.

Regulatory Divergence: U.S. vs. Global

The U.S. is shifting. After years of pushing strict capital rules like the failed Basel III endgame, federal agencies announced a new direction in July 2025. The Federal Reserve hosted a regulatory capital conference with banks, fintechs, and even crypto firms. The message? We’re listening. We’re not just adding more rules - we’re rethinking how they work. Meanwhile, the rest of the world is going in opposite directions. The EU tightened leverage limits on crypto derivatives in 2024. Singapore introduced mandatory risk disclosures for platforms offering over 20x leverage. Japan requires leverage caps based on trader experience levels. But in places like Dubai, the Seychelles, and the British Virgin Islands, leverage remains virtually unregulated. Traders can hop jurisdictions to find the best terms - and the biggest risks. This isn’t just about geography. It’s about philosophy. The U.S. is moving toward collaboration. Other regions are moving toward control. Crypto markets? They’re moving toward innovation - with little oversight.The Real Risk Isn’t Leverage - It’s Ignorance

Regulators can cap leverage all they want. But if a trader doesn’t understand margin calls, funding rates, or liquidation thresholds, no rule will save them. The most dangerous thing in leverage trading isn’t 500x. It’s thinking you’re safe because you’re trading on a “regulated” platform that doesn’t actually protect you. The best traders today don’t chase the highest leverage. They chase the best tools. Platforms like Leverage.Trading, Deribit, and BitMEX now offer real-time risk dashboards, position simulators, and automated stop-loss builders. These aren’t marketing gimmicks. They’re survival tools. In 2026, the difference between a profitable trader and a wiped-out one isn’t the leverage ratio. It’s whether they’ve practiced their strategy before risking real money.

What Comes Next? Three Predictions for 2026

- More U.S. crypto licensing: The SEC and CFTC are under pressure to clarify rules. Expect a new category of “crypto derivatives broker” with mandatory leverage disclosures and risk education requirements - but no hard caps. Think of it as “regulated freedom.”

- Global risk reporting standards: Leverage.Trading’s monthly report is becoming a benchmark. In 2026, we’ll see regulators requiring exchanges to submit anonymized trader behavior data. Not to ban leverage, but to understand it.

- AI-powered margin alerts: Platforms will start using AI to predict when a trader is about to get liquidated - and send them a warning before it happens. Not to save them, but to give them a chance to adjust. This isn’t babysitting. It’s smart risk design.

What You Should Do Right Now

- If you’re in the U.S.: Stick to CFTC-regulated brokers for forex. For crypto, use platforms that clearly state their jurisdiction and offer negative balance protection - even if they’re offshore.

- If you’re outside the U.S.: Know your local rules. Some countries now require leverage limits on crypto. Others don’t. But even if it’s legal, ask: does this platform have a history of fair liquidations?

- For everyone: Never trade leverage without testing your strategy in a simulator first. Use tools like Leverage.Trading’s risk checker. Run five different scenarios. What happens if the market moves 10% against you? What if funding rates spike? What if your stop-loss doesn’t trigger?

The future of leverage trading isn’t about banning it. It’s about making it smarter. The days of reckless 100x bets are fading. The ones that survive will be the ones who treat leverage like a scalpel - not a sledgehammer.

Is 100x leverage legal in the U.S.?

No. U.S. regulators cap forex leverage at 1:50 for retail traders. Crypto leverage isn’t directly regulated by U.S. agencies, but platforms offering 100x+ leverage to U.S. residents risk violating securities and commodities laws. Most major exchanges like Binance and Coinbase block U.S. users from high-leverage products unless they’re on their regulated U.S. entities, which cap leverage at 10x or lower.

Why do crypto exchanges offer 500x leverage?

Because they can. Most crypto exchanges are based offshore in jurisdictions with light or no leverage regulations. High leverage attracts traders looking for explosive returns - and those traders are willing to pay higher fees and funding rates. Exchanges profit from volume, not just spreads. The risk is pushed onto the trader, not the platform - as long as the trader’s account is fully collateralized.

Can regulators shut down high-leverage crypto platforms?

They can try, but it’s hard. Many operate outside national borders and use decentralized infrastructure. The U.S. can block access for its citizens, and the EU can fine platforms that serve EU residents. But if a platform has no physical presence in your country and doesn’t accept your currency directly, enforcement becomes nearly impossible. That’s why education and self-regulation are becoming the real tools of control.

Are there any safe leverage trading strategies?

Yes - but they’re not about leverage. They’re about risk management. Use no more than 5x leverage on crypto, always set stop-losses, never risk more than 1% of your account on a single trade, and test every strategy in a simulator first. The goal isn’t to win big - it’s to survive long enough to win consistently.

How do funding rates affect leveraged crypto trades?

Funding rates are periodic payments between long and short traders in perpetual futures. If you’re long and funding is positive, you pay. If you’re short and funding is negative, you pay. Over time, these small fees add up - sometimes $10-$50 a day on a $50,000 position. High leverage magnifies both profits and these costs. Ignoring funding rates is like ignoring interest on a credit card - you’ll lose money even if the market moves in your favor.

Linda Prehn

January 22, 2026 AT 00:21So let me get this right we’re supposed to trust some offshore crypto exchange with 500x leverage because they have a fancy risk dashboard but the US government can’t be trusted to protect us from blowouts? I mean if you’re gonna gamble why not just go to Vegas and save the bandwidth

Adam Fularz

January 22, 2026 AT 15:16u.s. regulators are just scared of innovation. 1:50 leverage is for people who dont know how to read a chart. if you cant handle 100x then you prob shouldnt be trading at all. the real problem is people think regulation = safety when its really just a barrier to entry for the smart ones

Paru Somashekar

January 23, 2026 AT 21:16While I appreciate the detailed analysis, I must emphasize that leverage, regardless of multiplier, is a double-edged sword. Without proper risk management, even 2x leverage can lead to catastrophic losses. Education, not regulation, is the cornerstone of sustainable trading. Always backtest, always simulate, always respect the market.

Heather Crane

January 24, 2026 AT 13:11This is exactly why I started using Leverage.Trading’s simulator last year. I thought I was ready for 50x... then I lost 30% in one day because I forgot about funding rates. Now I run five scenarios before I even click open. It’s not about being scared-it’s about being smart. Thank you for writing this. 🙏

Chidimma Catherine

January 25, 2026 AT 10:36From Nigeria I see traders here using 200x leverage on Binance and thinking they are geniuses. They lose everything. Then they blame the platform. But no one teaches them how to read a margin call. No one tells them funding rates can eat their profits like termites. This article is a lifeline. Please share it with every beginner you know.

David Zinger

January 27, 2026 AT 06:09U.S. regulators are cowards. Canada lets us trade 100x on regulated platforms. We have risk disclosures, we have insurance funds, we have transparency. But no, America has to lock everyone in a 1:50 straitjacket because some guy lost his house in 2020. Grow up. Innovation doesn’t happen in a cage. 🇨🇦🔥

Arielle Hernandez

January 27, 2026 AT 06:13The most insightful part of this post is the shift from control to collaboration. Regulators aren’t just enforcing rules anymore-they’re observing behavior. The fact that Leverage.Trading’s global reports are becoming benchmarks means the industry is maturing. This isn’t the Wild West anymore. It’s a laboratory. And the traders who survive are the ones who treat it like science, not gambling.

Nathan Drake

January 27, 2026 AT 15:29What if the real question isn’t whether leverage should be capped-but whether we’re even capable of understanding risk at all? We build tools to simulate losses, yet we still place trades with half our savings. We call it strategy. It’s just hope dressed in charts. Maybe the problem isn’t the 500x. Maybe it’s the belief that we can outsmart probability.

Taylor Mills

January 28, 2026 AT 23:13lol the ‘ai margin alerts’ are just a way for exchanges to make you feel safe while they still front run your liquidations. you think they care if you live or die? they make money on every trade, every funding rate, every forced close. the ‘smart risk design’ is just a marketing term for ‘we’re still gonna get you’

Mike Stay

January 30, 2026 AT 17:24The evolution of leverage regulation is a mirror of our broader relationship with technology and autonomy. We used to trust institutions to protect us from ourselves. Now we trust algorithms, dashboards, and simulations. But who designs them? Who audits them? And more importantly-do we understand them? The real question isn’t whether 100x is legal. It’s whether we’ve become so reliant on tools that we’ve forgotten how to think for ourselves.

george haris

January 31, 2026 AT 10:38I’ve been trading for 8 years and I still use a 5x max. Why? Because I’ve seen too many smart people blow up chasing 100x. I don’t need to win big-I need to stay in the game. The tools mentioned here are amazing, but they’re useless if you don’t have discipline. Start small. Learn the math. Then scale. You’ll thank yourself in 5 years.

HARSHA NAVALKAR

February 2, 2026 AT 04:19why do people still think regulation is the answer? the market always finds a way. if the us bans 100x, traders just use vpn and offshore accounts. the real solution is personal responsibility. no app, no warning, no regulator can save someone who doesn’t want to learn. i lost everything once. now i simulate every trade. no one else can do that for you.