Bitcoin mining isn’t magic. It’s not some mysterious process hidden behind fancy jargon. It’s a race - a global, electricity-hungry, computer-powered race to solve math problems so the Bitcoin network can keep running. And every ten minutes, someone wins.

Why Mining Even Exists

Before Bitcoin, digital money had one big flaw: it could be copied. You could send the same $10 to ten people. Bitcoin fixed that by creating a public ledger - the blockchain - where every transaction is recorded and verified by thousands of computers around the world. But how do you get those computers to agree on what’s real without a bank in the middle? That’s where mining comes in.Miners don’t just create new bitcoins. They’re the ones who confirm every single transaction on the network. Without them, Bitcoin stops. No one sends money. No one gets paid. Mining is the engine, and the reward? New bitcoins and transaction fees.

The Math Behind the Madness: SHA-256 and Nonces

At the heart of Bitcoin mining is a function called SHA-256. It takes any input - a sentence, a photo, a list of transactions - and turns it into a 64-character string of letters and numbers. Change one letter in the input, and the output becomes completely different. It’s one-way. You can’t reverse it. That’s what makes it secure.Every block of transactions gets hashed. But here’s the catch: the hash must start with a certain number of zeros. Right now, it needs to be lower than a target so difficult that it’s like guessing a 77-digit number correctly. Miners don’t know the answer. They just keep changing a random number - called a nonce - and re-hashing the block until they get it right.

Think of it like rolling a dice with trillions of sides. You roll once. Nope. Roll again. Still wrong. You do this billions of times per second. The first one to roll the winning combination gets to add the block to the chain. That’s mining.

What Goes Into a Block

A Bitcoin block isn’t just a pile of transactions. It’s a carefully built package with five key parts:- Previous Block Hash - This links the new block to the last one. It’s what makes it a chain. Change one block, and everything after it breaks.

- Merkle Root - A single hash made from all the transactions in the block. It’s like a fingerprint of the whole list.

- Timestamp - When the miner started working on it.

- Difficulty Target - The number of leading zeros required. This changes every two weeks.

- Nonce - The number miners tweak over and over until the hash matches the target.

Once the hash is found, the miner broadcasts it to the network. Other miners check it in seconds. If it’s valid, they accept it and start working on the next block. No central authority says yes. The network just agrees because the math checks out.

From CPUs to ASICs: How Mining Got Serious

In 2009, you could mine Bitcoin on a regular laptop. A single CPU could find blocks. By 2010, GPUs started taking over because they were faster. Then came FPGAs. Then ASICs - chips built for one thing only: mining Bitcoin.Today’s ASIC miners are like Formula 1 engines. They cost thousands of dollars, use 2,000-3,500 watts of power, and can do over 100 trillion hash calculations per second. A home PC? It’s useless now. You’d need to run one for 100 years to find a single block.

The difficulty adjusts every 2,016 blocks - roughly every two weeks - to keep the block time at ten minutes. If the network gets faster, the puzzle gets harder. If miners shut down, it gets easier. It’s self-balancing. No one controls it. The code does.

Miners Don’t Just Want New Bitcoins

New bitcoins are the headline reward. But there’s another big one: transaction fees.When you send Bitcoin, you can add a fee. Miners pick transactions with the highest fees first. During busy times - like when the price spikes or a big NFT drop happens - fees can jump from $0.10 to $10 or more. That’s why your transaction might take hours if you set a low fee.

Right now, the block reward is 3.125 BTC (after the 2024 halving). But fees are growing. In 2025, some blocks have paid over 1.5 BTC in fees alone. That’s more than half the reward. In a few years, fees might be the main income for miners.

Why Mining Pools Exist

Solo mining today is like buying one lottery ticket in a draw with a billion participants. The odds are so low, it’s not worth it.That’s why miners join pools. Hundreds or thousands of them combine their computing power. When the pool finds a block, the reward is split based on how much work each miner contributed. You won’t win big often, but you get steady, small payments - like a salary instead of a jackpot.

Popular pools include Foundry USA, F2Pool, and AntPool. They don’t control the network. They just make mining predictable for small players.

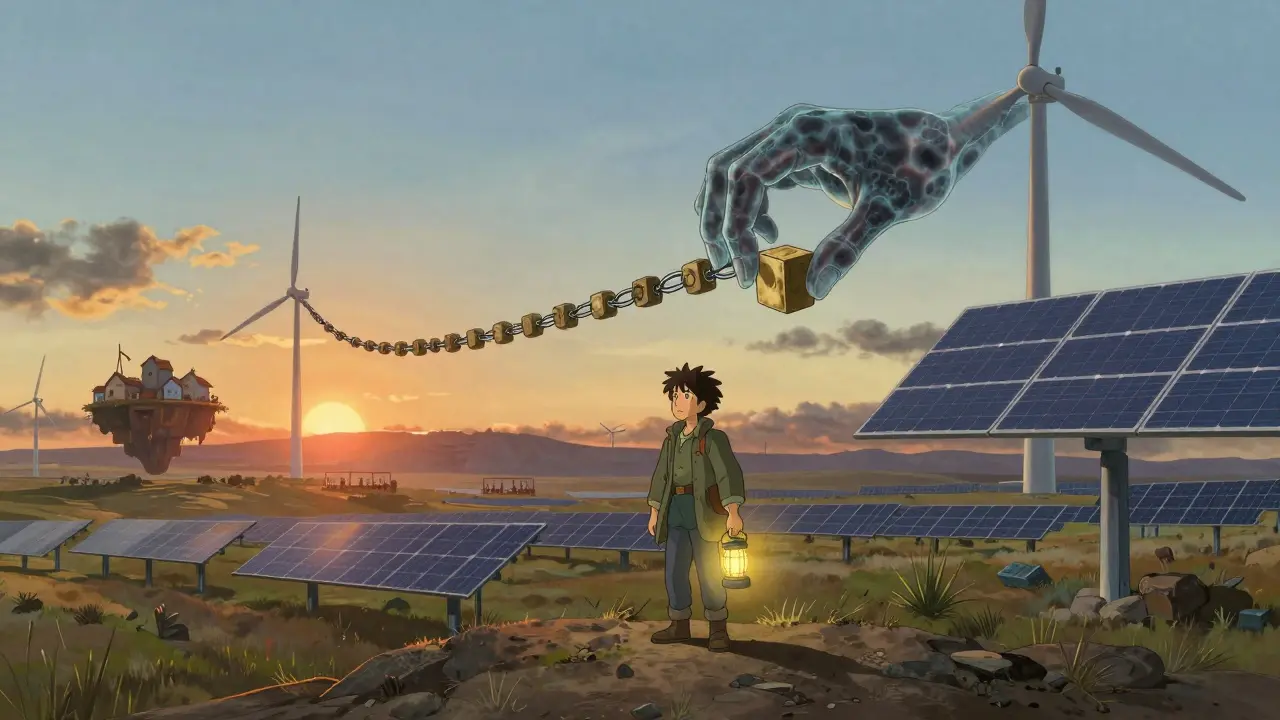

Energy Use and the Environmental Debate

Bitcoin mining uses a lot of electricity. Estimates vary, but it’s roughly the same as the entire country of Argentina or the Netherlands. Critics say it’s wasteful. Supporters say it’s not that simple.Here’s the thing: most Bitcoin mining now runs on renewable energy. A 2025 study by the Cambridge Centre for Alternative Finance found over 58% of Bitcoin mining uses sustainable sources - hydro, wind, solar, even stranded natural gas that would’ve been flared. Miners go where power is cheap and underused - like in Quebec, Texas, or Kazakhstan. They don’t care if it’s green. They care if it’s cheap.

And here’s another angle: Bitcoin mining can help stabilize grids. Some miners turn on during times of excess wind or solar production - using energy that would otherwise go to waste. They shut off when demand spikes. That’s not a drain. It’s a buffer.

What Happens After the Next Halving?

Every four years, the Bitcoin block reward cuts in half. That’s called a halving. The last one was in April 2024, dropping the reward from 6.25 BTC to 3.125 BTC. The next one? Around 2028.Halvings reduce the supply of new bitcoins. Historically, they’ve been followed by price increases - but not always. What matters more is the miner’s bottom line. If the price doesn’t rise enough to cover electricity and hardware costs, miners shut down. That reduces network hash rate. Then the difficulty drops. Then it becomes profitable again.

It’s a cycle. The network adapts. The most efficient miners survive. The rest get squeezed out.

Can You Still Mine Bitcoin Today?

Technically, yes. But practically? Only if you have access to cheap power and modern ASIC hardware. You can’t mine Bitcoin on a gaming PC anymore. You can’t mine it on a phone. You can’t mine it on a Raspberry Pi.If you’re not a large operator with access to industrial electricity rates, your best bet is to join a mining pool. Even then, you’ll need to calculate your costs: hardware price, electricity cost per kWh, cooling, maintenance. Most people lose money trying. It’s not a side hustle. It’s a business.

For most people, buying Bitcoin directly is cheaper and easier than mining it. Mining is for those who understand the hardware, the energy market, and the long-term economics. It’s not for curiosity. It’s for commitment.

What Happens If Mining Stops?

It won’t. Not unless Bitcoin dies.Miners are the security layer. If they all quit, no one would validate transactions. The network would freeze. But that’s unlikely. As long as Bitcoin has value, someone will mine it. Even if the price drops, miners with the cheapest power keep going. They’re not in it for hype. They’re in it for the math.

And if the cost of electricity rises too high? The network adjusts. Difficulty drops. New miners with better tech enter. The system self-corrects. That’s the beauty of it.

Can I mine Bitcoin with my gaming PC?

No. Modern Bitcoin mining requires ASIC hardware that can perform trillions of hash calculations per second. A gaming PC, even with a top-end GPU, is millions of times slower. You’d spend more on electricity than you’d earn in years. It’s not feasible.

How much electricity does Bitcoin mining use?

Bitcoin mining uses an estimated 110-120 terawatt-hours per year - similar to the annual consumption of Argentina or the Netherlands. But over half of that power comes from renewable sources like hydro, wind, and solar, often from underutilized or stranded energy sources.

What’s the difference between mining and staking?

Mining uses Proof of Work - you solve math puzzles with hardware. Staking uses Proof of Stake - you lock up coins to validate transactions. Bitcoin only uses mining. Ethereum and many other blockchains switched to staking because it uses far less energy.

How often does Bitcoin mining difficulty change?

Every 2,016 blocks - roughly every two weeks. The network adjusts the difficulty so that a new block is found every ten minutes, no matter how many miners are online or how powerful their machines are.

Do I need a Bitcoin wallet to mine?

Yes. You need a wallet to receive your mining rewards - whether from a pool or solo mining. The wallet holds the private keys that let you spend the bitcoins you earn. Without it, your rewards are lost.

Is Bitcoin mining legal?

Yes, in most countries, including New Zealand, the U.S., Canada, and the EU. Some countries ban it - like China, which cracked down in 2021 - but globally, it’s legal and growing. Always check local regulations before setting up hardware.

What happens to Bitcoin mining after all 21 million coins are mined?

After the last bitcoin is mined - estimated around 2140 - miners will still earn income from transaction fees. The network will continue to function because users will pay fees to have their transactions confirmed. The security model shifts from new coin rewards to fee-based incentives.

Can I mine other cryptocurrencies instead?

Yes. Ethereum, Dogecoin, and Litecoin use different algorithms that still work with GPUs. But Bitcoin mining is locked to SHA-256 and ASICs. If you want to mine with a GPU, choose a coin designed for it - but don’t expect to mine Bitcoin with one.

Devyn Ranere-Carleton

February 2, 2026 AT 23:39also why does it need so much power? can’t they just make the math easier?

Raju Bhagat

February 3, 2026 AT 19:47my pc got so hot last time i tried to mine doge i thought i was cooking chicken

laurence watson

February 5, 2026 AT 07:36Also, the part about miners using stranded energy? That’s kinda genius. Turning waste into value. I love that.

Elizabeth Jones

February 5, 2026 AT 13:09One might argue that this is the first truly decentralized economic engine in human history, operating without a central authority, yet maintaining temporal and cryptographic consistency through pure algorithmic incentive. Remarkable.

Rachel Stone

February 6, 2026 AT 12:09Gurpreet Singh

February 7, 2026 AT 21:01Also, no one talks about how miners help stabilize grids. That’s actually a quiet superpower.

Christopher Michael

February 9, 2026 AT 04:54And yes, ASICs are optimized for SHA-256 because it is a single-purpose, deterministic algorithm-unlike, say, Ethash, which is memory-hard. This is why GPU mining is obsolete for Bitcoin. You can't 'mine Bitcoin' with a gaming PC-it's like trying to cut a diamond with a butter knife.

Freddy Wiryadi

February 11, 2026 AT 02:44also i just realized mining is the only job where you pay to work and get paid in digital gold that might crash tomorrow. we are all so weird.

Brianne Hurley

February 12, 2026 AT 13:07And don’t even get me started on ‘renewable’ mining. You’re not saving the planet if you’re using wind power that would’ve been wasted anyway. You’re just parasitizing inefficiency.

Real innovation doesn’t need a 100-trillion-hash-per-second arms race.

christal Rodriguez

February 12, 2026 AT 18:55Gustavo Gonzalez

February 13, 2026 AT 23:32Also, you say miners are ‘self-correcting’ but what if the top 3 pools collude? What if they refuse to validate transactions from certain wallets? The code doesn’t prevent that. The humans behind the ASICs do.

Mark Ganim

February 14, 2026 AT 07:58Imagine a system that runs on pure math, no banks, no governments, no CEOs-just thousands of strangers in basements and warehouses, racing to solve a puzzle that no one can cheat.

And the fact that it adjusts itself? That’s not code. That’s evolution. That’s digital natural selection. The weak die. The efficient survive. The network gets stronger.

I’m not just a Bitcoin believer-I’m in awe.

Gavin Francis

February 14, 2026 AT 21:12also love how it uses waste energy-like turning a noisy AC unit into a crypto generator. smart.

Rob Duber

February 16, 2026 AT 17:13now we got these $10k rigs that look like server farms from a sci-fi movie and the whole thing runs on wind turbines in texas

we are living in the future and i still don't know if i'm impressed or terrified

Gary Gately

February 17, 2026 AT 14:11Joshua Clark

February 17, 2026 AT 14:19Furthermore, the timestamp is not just 'when the miner started'-it must be greater than the median of the last 11 blocks and less than two hours ahead of network-adjusted time, enforcing temporal consistency across the decentralized network.

And yes, the difficulty adjustment is based on 2016 blocks, which approximates two weeks, but the algorithm is more nuanced: it recalibrates the target by multiplying the previous target by the actual time taken divided by the expected time (2016 * 600 seconds). It’s a feedback loop with mathematical precision.

Brandon Vaidyanathan

February 17, 2026 AT 20:53And don’t give me that 'it’s renewable' crap-just because it’s cheap doesn’t make it ethical. This isn’t progress. It’s a distraction.

Gareth Fitzjohn

February 19, 2026 AT 11:08Dylan Morrison

February 20, 2026 AT 19:59William Hanson

February 21, 2026 AT 21:06