Blockchain Cost & Speed Calculator

Solana

High-performance blockchain

Ethereum

Established, secure blockchain

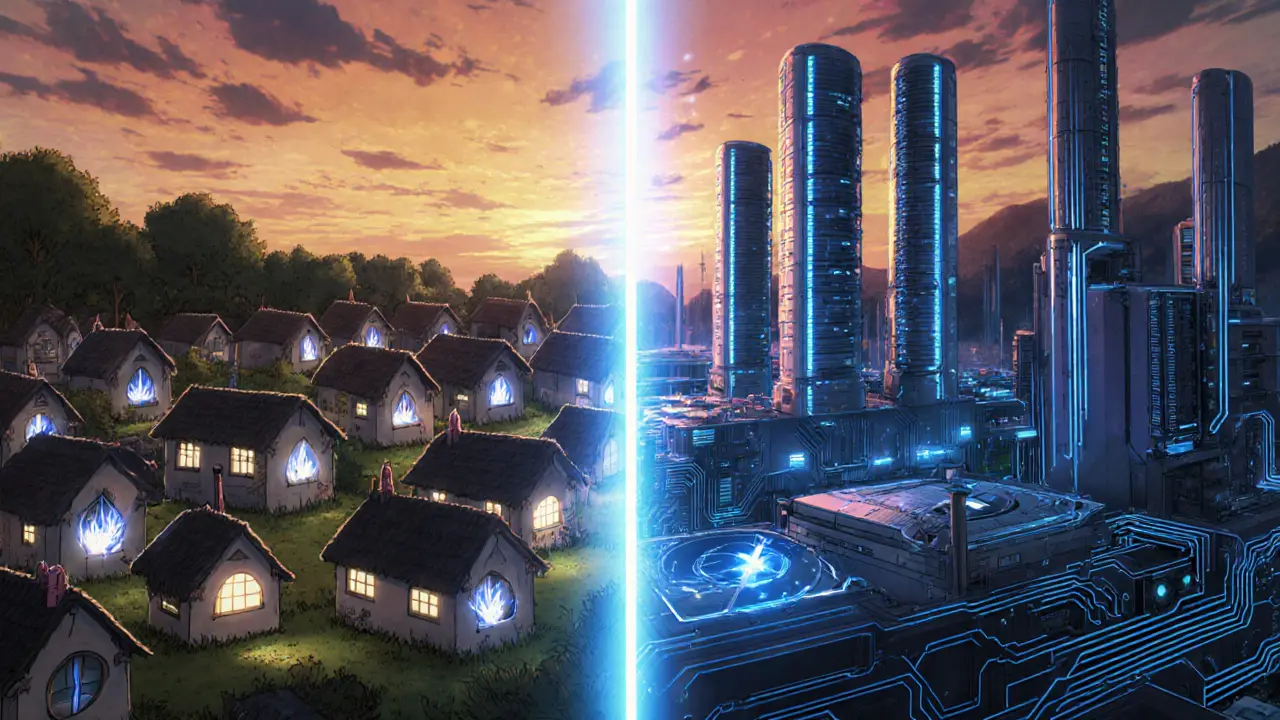

If you’ve been following crypto news, you’ve probably seen the endless back‑and‑forth between Solana and Ethereum. Both claim to be the best platform for decentralized apps, but they take completely different routes to get there. This article breaks down the two blockchains side‑by‑side, so you can decide which one fits your project, wallet, or curiosity.

Ethereum at a Glance

Ethereum is a public, permissionless blockchain that introduced smart contracts and the concept of decentralized applications (dApps) in 2015. Launched by Vitalik Buterin, it uses a Proof‑of‑Stake (PoS) consensus after the September 2022 Merge, allowing validators to secure the network by staking ETH. As of October 2025, Ethereum runs around 15-30 transactions per second (TPS) on Layer1, with block times near 12seconds. Security and decentralization are its core strengths, supported by over 800,000 active validators.

Solana at a Glance

Solana is a high‑throughput blockchain launched in 2020 by Anatoly Yakovenko. It combines Proof‑of‑Stake with a novel Proof‑of‑History (PoH) clock to order events before consensus, enabling sub‑second block times and real‑world throughput of roughly 870TPS, with peaks above 4,700TPS. The network’s design targets speed and low cost, but it requires validators to run powerful hardware (e.g., NVIDIA A100 GPUs, 128GB RAM), which has raised centralization concerns.

Consensus Mechanics: PoS vs PoH

Proof‑of‑Stake is a consensus algorithm where validators lock up tokens to propose and attest to blocks. Ethereum’s PoS rewards honest behavior and penalizes malicious actors through slashing. In contrast, Solana’s Proof‑of‑History uses a verifiable delay function to timestamp events, creating a cryptographic ordering that speeds up consensus. The combination of PoS (for security) and PoH (for ordering) lets Solana achieve block times of roughly 0.39seconds and finality under 13seconds.

Performance Metrics: Speed, Throughput, and Finality

When you compare raw numbers, Solana outpaces Ethereum by a large margin. Solana processes about 870TPS on average, with theoretical peaks of 65,000TPS, while Ethereum stays in the 15‑30TPS range on Layer1. However, Ethereum’s Layer‑2 solutions (Optimism, Arbitrum, Starknet) collectively push daily transaction volumes past 1.2million, effectively bridging the speed gap for many use cases.

Finality-how quickly a transaction is irrevocably settled-also diverges. Solana’s sub‑second blocks lead to ~12.8seconds finality. Ethereum’s 12‑second blocks plus PoS finality yield roughly 6‑12seconds on average, but network congestion can delay confirmation when blocks fill up.

Decentralization and Validator Landscape

Ethereum prides itself on a sprawling validator set: over 800,000 active validators as of Oct102025, each requiring modest hardware (2CPU cores, 2GB RAM). Solana, by contrast, has around 1,942 validators, each needing high‑end servers. This disparity fuels a debate-Ethereum’s broader validator base offers stronger decentralization, while Solana’s smaller, resource‑intensive set can lead to points of failure, as seen in six documented outages in 2024 totaling 17hours of downtime.

Transaction Costs: Fees in Practice

Fees are where the two chains differ most dramatically. On Solana, the average fee sits at $0.00025 per transaction, making micro‑payments and high‑frequency NFT minting cheap. Ethereum’s Layer‑1 fees average $1.27 under normal conditions, but can spike past $50 during network congestion, turning simple swaps into expensive operations.

Developers and users often mitigate Ethereum’s fee volatility with Layer‑2 rollups, which can bring fees down to a few cents. Solana, by design, keeps fees low at the base layer, eliminating the need for rollups for most everyday transactions.

Ecosystem Maturity: dApps, DeFi, and NFTs

Ethereum’s ecosystem remains the largest: nearly 5,000 dApps, 290million active addresses, and a deep DeFi layer handling billions in value (e.g., Lido’s $18.7B liquid‑staking market). Major NFT collections like CryptoPunks still dominate trading volume on Ethereum.

Solana’s ecosystem is smaller but growing fast: over 440 dApps, 100million active addresses, and a strong presence in NFT marketplaces (TensorSwap processes 1.2M NFT transactions daily) and decentralized exchanges (Jupiter trades $427M daily). Solana handles over 100M transactions per day, outpacing Ethereum’s Layer‑1 volume.

Developer Experience and Tooling

Ethereum benefits from a mature toolchain: Hardhat, Truffle, and Remix are standard, and the EVM compatibility lets developers port code to 60+ EVM‑compatible chains. A 2025 ETHGlobal survey shows 68% of developers use Hardhat for their projects.

Solana developers work primarily in Rust, which has a steeper learning curve-only 22% reported prior Rust experience before starting on Solana. However, the Solana Mobile Stack and high‑throughput capabilities enable novel UX, such as the Saga smartphone’s Seed Vault handling 4.7M transactions in Q32025.

Funding differs too: the Ethereum Foundation allocated $17.3M in grants in 2025, while the Solana Foundation disbursed $42.8M, including $15M for Q3 hackathons that produced over 1,200 projects.

Use‑Case Suitability: When to Pick Which Chain

- High‑frequency trading, low‑cost micro‑payments, and large‑scale NFT drops: Solana’s speed and cheap fees make it ideal.

- Institutional DeFi, high‑value smart contracts, and projects requiring maximal security: Ethereum’s deep validator pool and battle‑tested security are hard to beat.

- Projects that need both speed and security: Consider a hybrid approach-deploy core contracts on Ethereum and use Solana for off‑chain data or secondary transactions via cross‑chain bridges.

Roadmaps and Future Outlook

Ethereum is gearing up for Proto‑Danksharding (EIP‑4844) in early 2026, projected to cut Layer‑2 data costs by 90%. Verkle trees slated for Q32026 aim to shrink node storage by 90%.

Solana is focusing on its Firedancer validator client, which Jump Crypto says could boost throughput to 1.2MTPS by late 2026. QUIC protocol optimizations aim for a 50% reduction in transaction propagation latency by the end of 2025.

Both chains will coexist for the foreseeable future-Ethereum leads in security and institutional adoption, while Solana carves out a niche in consumer‑facing, high‑throughput applications.

Side‑by‑Side Comparison

| Metric | Solana | Ethereum |

|---|---|---|

| Consensus | Hybrid PoS + PoH | Proof‑of‑Stake |

| Block Time | ~0.39seconds | ~12seconds |

| TPS (real‑world) | ≈870TPS (peaks>4,700) | 15‑30TPS |

| Finality | ≈12.8seconds | ≈6‑12seconds |

| Average Transaction Fee | $0.00025 | $1.27 (spikes>$50) |

| Active Validators | ~1,942 | ~812,431 |

| dApps (approx.) | 440+ | 5,000+ |

| Daily Transactions (Layer1) | >100M | 1.2M |

| Market Cap (Oct2025) | $68.2B | $312.4B |

Frequently Asked Questions

Which chain has lower fees for NFT minting?

Solana’s average fee of $0.00025 makes large‑scale NFT drops extremely cheap, whereas Ethereum’s fees can exceed $50 during congestion, dramatically increasing minting costs.

Is Solana less decentralized than Ethereum?

Yes. Ethereum has over 800,000 validators using modest hardware, while Solana’s validator set is under 2,000 and requires high‑end servers, leading to higher centralization risk.

Can I use Ethereum tooling to develop on Solana?

Not directly. Solana’s smart contracts are written in Rust and run on the Sealevel runtime, while Ethereum uses the EVM and languages like Solidity. However, cross‑chain bridges let you interact between the two ecosystems.

What’s the roadmap for improving Ethereum’s scalability?

Ethereum is rolling out Proto‑Danksharding (EIP‑4844) in early 2026 to slash Layer‑2 data costs, followed by Verkle trees to reduce node storage. These upgrades aim to keep transaction costs low while preserving security.

Will Solana’s high‑throughput advantage last?

Solana’s roadmap includes the Firedancer client and QUIC optimizations, targeting up to 1.2MTPS by 2026. While performance is set to stay ahead, network reliability and decentralization remain challenges that could affect long‑term adoption.

Tayla Williams

October 15, 2025 AT 08:22It is incumbant upon every conscientious participant in the blockchain ecosystem to prioritize decentralisation over fleeting performance gains, lest we betray the very principles upon which these networks were founded. One must not excuse high throughput if it comes at the expense of equitable validator participation.

Brian Elliot

October 16, 2025 AT 12:09I appreciate the thorough comparison, and I think it’s useful to contextualize both networks within broader ecosystem goals. While Solana offers impressive throughput, Ethereum’s robust tooling and mature security model remain compelling for developers seeking stability. Considering these factors can help teams make informed choices without polarizing the discourse.

Marques Validus

October 17, 2025 AT 15:56Solana’s lightning TPS really feels like a sci‑fi dream for developers craving speed. Ethereum, on the other hand, still drags its feet with gas fees that can skyrocket during congestion. The trade‑off between raw performance and decentralised security is a classic dilemma. Many projects chase low‑cost transactions but ignore the risk of validator centralisation. The high‑end hardware requirement for Solana nodes can create a barrier to entry for hobbyist validators. Meanwhile Ethereum’s proof‑of‑stake model spreads staking opportunities more evenly across the globe. Layer‑2 solutions try to bridge the gap by off‑loading work while still anchoring to Ethereum’s safety net. Yet they add complexity and require careful contract design. Developers must weigh the operational overhead of managing Rust on Solana versus Solidity’s broader community support. Gas‑optimisation techniques can tame Ethereum fees but demand deep expertise. Community incentives also differ; Solana’s rapid upgrade cadence appeals to early adopters. Ethereum’s measured roadmap, with shards and rollups, promises scalability without sacrificing trust. Users often overlook the importance of finality speed, which on Solana can be sub‑second while Ethereum lags behind. Security audits are more plentiful for Ethereum contracts, given its longer history. Cross‑chain bridges provide interoperability, yet they introduce new attack surfaces. In the end, your choice should reflect project priorities, risk tolerance, and long‑term vision.

Jordan Collins

October 18, 2025 AT 19:42The data on validator counts is striking; fewer than 2,000 validators on Solana versus hundreds of thousands on Ethereum raises genuine decentralisation concerns. It would be interesting to see how upcoming upgrades address network reliability without compromising those numbers.

Andrew Mc Adam

October 19, 2025 AT 23:29I concur with your observation and would add that the upcoming Firedancer client may alleviate some reliability worries, though its reliance on specialised hardware could deepen centralisation trends. Moreover, the community’s excitement around 1.2 MTPS targets may blind stakeholders to governance trade‑offs. It is crucial that we maintain visivility as performance goals evolve.

Shrey Mishra

October 21, 2025 AT 03:16The points you raise are valid, and the tension between speed and decentralisation cannot be ignored. While optimism about performance is understandable, a measured approach remains essential.

Ken Lumberg

October 22, 2025 AT 07:02Decentralization matters more than speed.

Blue Delight Consultant

October 23, 2025 AT 10:49Your moral appeal resonates, yet the practial realities of network economics cannot be dismissed. In many cases, users prioritize lower fees and faster confirmation times, especially for micro‑transactions. Balancing ethical considerations with user demand is a nuanced challenge.

Shauna Maher

October 24, 2025 AT 14:36Don’t be fooled by the glossy marketing-both chains are controlled by a handful of shadowy entities pulling the strings. The fee spikes on Ethereum are engineered to enrich a select few, while Solana’s validator requirements lock out the average citizen.

Kyla MacLaren

October 25, 2025 AT 18:22I get the skepticism, but it’s also true that many developers just want a reliable platform without getting tangled in conspiracies. Both ecosystems have open‑source contributors who genuinely care about decentralisation.

Linda Campbell

October 26, 2025 AT 21:09From an American perspective, the robustness of Ethereum’s security model aligns with the nation’s emphasis on resilient infrastructure. Its extensive validator network mirrors the democratic principles we cherish. Consequently, Ethereum should be regarded as the preferable foundation for mission‑critical applications.