Cryptocurrency

When working with Cryptocurrency, a digital asset secured by cryptography that operates on decentralized networks. Also known as digital currency, it powers everything from payment systems to complex finance apps. Stablecoins, coins pegged to a stable asset like the US dollar to reduce price swings are a major sub‑type, while Crypto Exchanges, platforms where users trade, deposit, and withdraw digital assets provide the marketplace. Cross‑Chain Bridges, tools that move tokens between different blockchains in a trustless or custodial way enable the ecosystem to stay connected. Together, these pieces form a vibrant, fast‑moving space that demands clear, actionable info.

Key concepts you’ll encounter

Understanding Cryptocurrency means grasping how stablecoins reduce volatility (subject‑predicate‑object: Stablecoins provide price stability for cryptocurrency users). It also means knowing that crypto exchanges are the gateways for buying, selling, and staking (subject‑predicate‑object: Crypto Exchanges enable trading of cryptocurrency). The rise of cross‑chain bridges shows that assets no longer stay locked to one chain (subject‑predicate‑object: Cross‑Chain Bridges connect different blockchains for cryptocurrency movement). In 2025, many readers are also curious about Crypto Staking, the process of locking tokens to earn rewards and support network security. Staking profitability versus mining is a hot debate, and our guides break down APR ranges, hardware costs, and risk factors. Another hot topic is airdrops – free token distributions that can boost portfolios overnight. We also cover niche areas like blockchain insurance regulation, which shapes how digital assets are protected in the real world. Each article in this collection ties back to the core idea that cryptocurrency is more than a buzzword; it’s a toolbox of interoperable technologies.

Below you’ll find a hand‑picked set of articles that walk you through the most relevant trends. From a deep dive into ExchangeCoin’s hybrid PoW/PoS model to practical step‑by‑step airdrop guides, from stablecoin mechanics to the nitty‑gritty of bridge fees, we’ve organized the content so you can jump straight to the topic that matters to you. Whether you’re hunting the best exchange, figuring out how to stake safely, or trying to understand why a new insurance rule matters, the posts below give you the data‑driven insights you need to act confidently in the crypto market today.

Globalcryptox claims to be a low-fee crypto exchange, but lacks transparency, security audits, and regulatory oversight. With inconsistent withdrawals, no insurance fund, and poor support, it's not a safe choice for serious traders in 2026.

BITPoint Japan is a regulated crypto exchange with low fees but has been inactive since 2024. No trading, no withdrawals, no support. Avoid it in 2026 - choose Coincheck or Bitflyer instead.

NovaBank (NVB) is a DeFi 3.0 protocol with a dual-token system and algorithmic rewards, but its price has crashed 93% from its peak. Learn how NVB works, its real risks, and whether it's still worth considering in 2026.

Cryptocurrency is giving creators direct control over payments, ownership of their work, and global access - bypassing banks and platforms that take huge cuts. No middlemen. No delays. Just real freedom.

P2P crypto trading in Russia is now the main way to buy and sell Bitcoin and other cryptocurrencies with rubles. Discover the top platforms, how payment methods work, and the real risks you need to avoid in 2026.

PointPay is a crypto banking platform offering trading, interest-bearing accounts, loans, and staking-all in one place. With EU licensing and up to 20% APY on PXP tokens, it's ideal for long-term crypto holders seeking real financial utility.

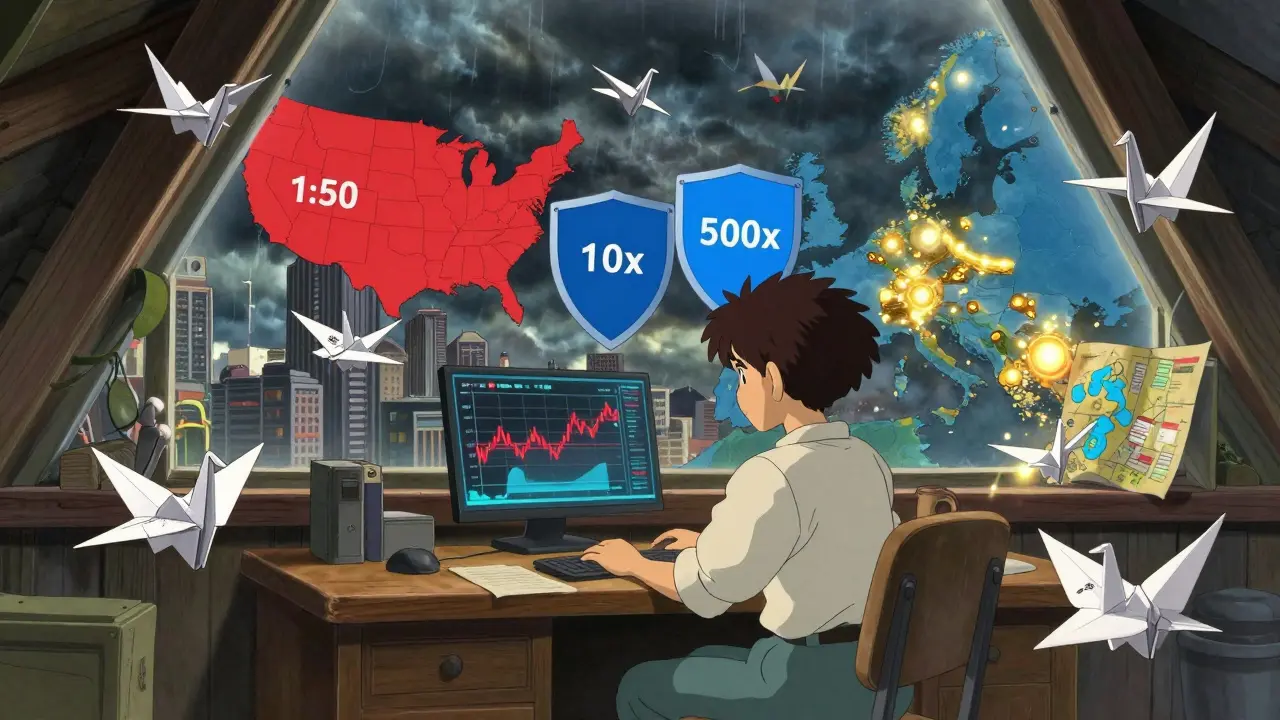

Leverage trading regulations are splitting globally in 2026. U.S. forex is capped at 1:50, crypto offers up to 500x, and risk tools are replacing bans. Here's what traders need to know.

COREDAX is a regulated South Korean crypto exchange focused on retail traders. It offers strong security, Korean-language support, and wire-only fiat deposits-but lacks global payment options, APIs, and a wide coin selection.

Crypto trading volume dropped sharply in 2025 after new regulations like the U.S. GENIUS Act and EU MiCA forced exchanges to restrict tokens and users. Despite Bitcoin hitting new highs, volume fell 28%-not because people lost interest, but because access became limited. This was a market maturing, not collapsing.

Kraken blocks crypto trading in over 20 countries and imposes complex rules in the U.S., Europe, Australia, and Japan. Learn which jurisdictions are restricted, why, and what you can still do.

Merchant adoption of crypto payments is accelerating in 2026, driven by stablecoins, lower fees, and global reach. Businesses from gaming to SaaS are cutting out banks and accepting crypto to serve customers faster and cheaper.

UBEX crypto exchange is a low-volume app with a nearly worthless token and no real users. Despite its clean interface, it lacks liquidity, regulatory compliance, and community trust. Avoid it and stick to established exchanges.